Why use The BearometerSM

You just lost a third of your net worth! What word comes to mind?

Stock market investors share a common concern. LOSING BIG MONEY. Why? Bear Markets. These are conditions where the markets drop more than 20%. Historically on average we’ve gone through one of these every 3 1/2 years and when they occur the average market loss is 35%.

Take one moment and add up everything you have invested in the markets. Did you include your 401(k)? Now take 1/3 of that amount. What’s the number? Now imagine that you just lost it! How does that impact you financially? Emotionally? If you were an investor in 2008 then you get it. If you’ve never experienced it, you don’t want to.

It can be emotionally devastating and very difficult to handle. Financially it sets you way back, if not ruin you. The older you are the more important it becomes to protect yourself from these large losses. Even market drops of 10-15% can be difficult. Historically we average a 10% correction once a year.

So how do you know when the markets will have their next drop? Answer is, You don’t. You CAN however be smart and prepare for it by protecting yourself every day.

The creation of The BearometerSM

Carlson Wealth Management although founded in 2010 by John Carlson was actually born during the devastating bear market of 2000-2002. It was the financial and emotional stress of markets that saw declines of 50% or more that drove Carlson, now a 30+ year industry veteran, to search for and ultimately find better answers in how to help protect investors from market downturns that can potentially destroy people’s lives.

After being introduced to the teachings and philosophy of Point and Figure analysis in the midst of this bear market Carlson began to develop daily logs of price data that he felt could ultimately lead to creating a systematic, disciplined and effective tool to help identify when markets were turning negative in order to take the necessary steps to help protect a portfolio. Years of hard work has now led to the technology called The BearometerSM

- Many investors carry more risk than they want or even realize they are taking.

- Portfolios are typically always invested – always on offense – always exposed to risk.

- Carlson Wealth Management believes there are also times to be on defense.

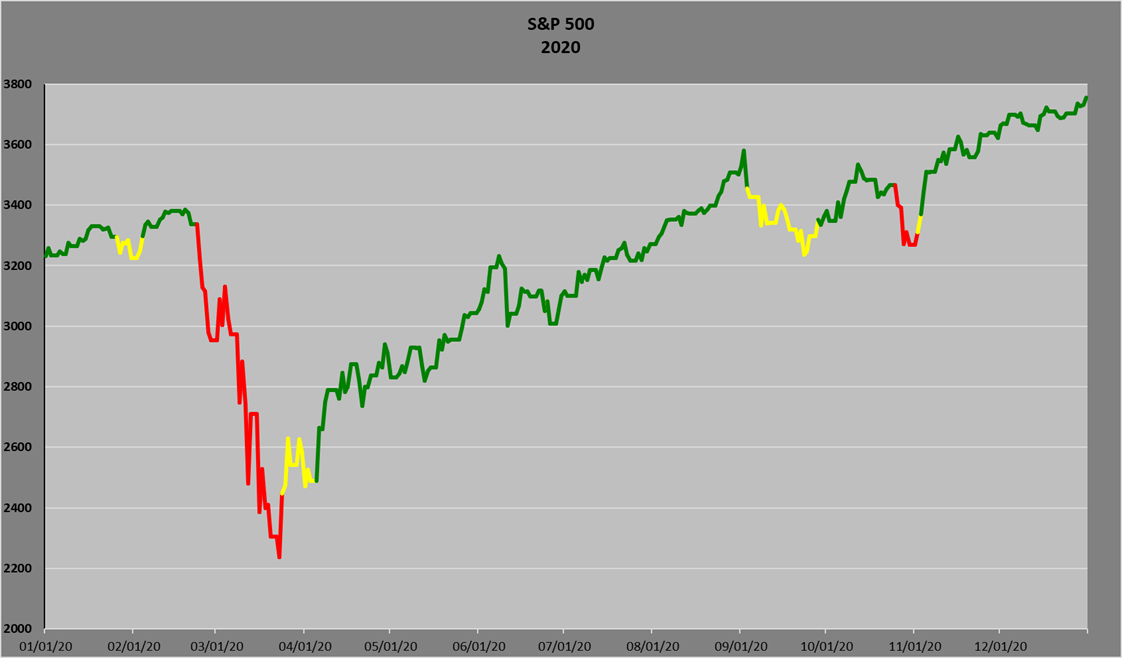

- To identify these times the company utilizes The BearometerSM, the market trend technology that systematically generates alerts to changes in market conditions.

- On Green alerts the objective is to help Grow your portfolio.

- On Yellow, and especially Red alerts, the objective is to help Protect it.

What if you were able to help protect your investments from bad markets?