Stock market investors share a common concern. LOSING MONEY.

Bear Markets are conditions where the markets drop more than 20%. Historically on average we go through one of these every 3 1/2 years and when they occur the average market loss is 35%.

Add up everything you have invested in the markets including your 401(k). Now deduct 1/3 of that amount. Are you ok losing that much? If you were an investor in recent years like 2000, 2008 or 2020 then you get it. If you’ve never experienced it, you don’t want to.

The 2000-2002 drop was the first bear market I experienced first hand as an advisor. It was emotionally devastating and very difficult to handle. Financially it sets you way back, if not ruin you. The older you are the more critical it becomes to preserve your wealth from these large losses.

Even market drops of 10-15% can be difficult especially if you are also withdrawing income from your portfolio. Historically we average a 10% correction once a year.

So how do you know when the markets will have their next drop? You really don’t. You can, however, be prepared by taking steps to help preserve your wealth every day.

The creation of The Defense

Carlson Wealth Management although founded in 2010 by John Carlson was actually born during the devastating bear market of 2000. It was the financial and emotional stress of markets that saw declines of 50-75% that drove Carlson, now a 35+ year industry veteran, to search for a way to help preserve investor’s wealth from market downturns that can potentially destroy lives.

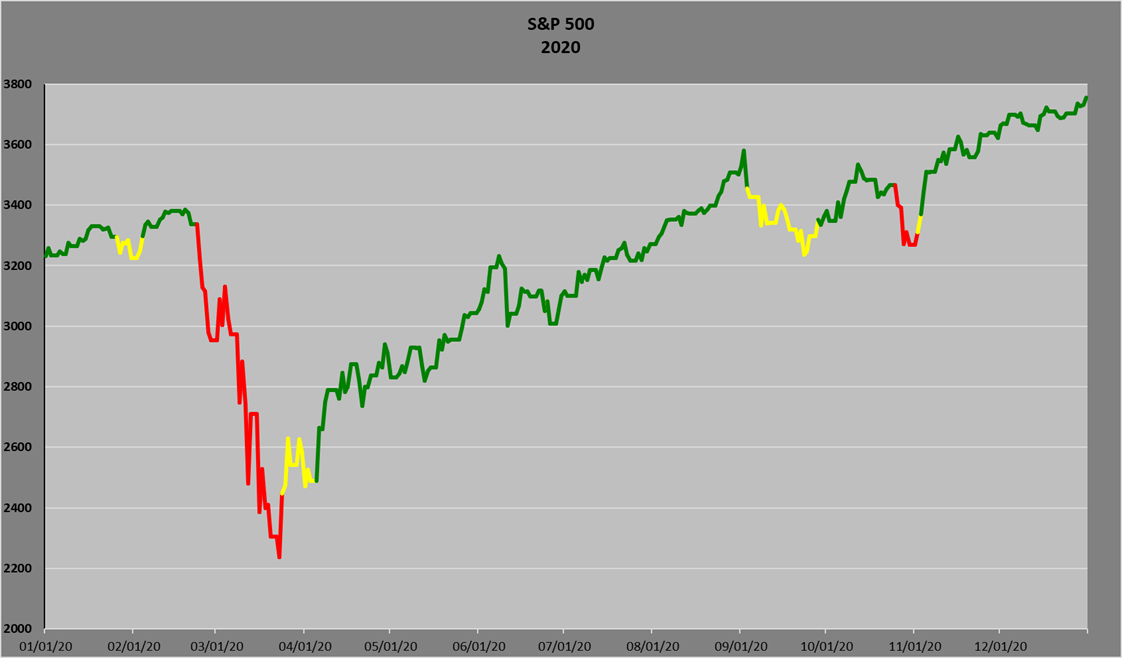

After being introduced to the teachings and philosophy of Point and Figure analysis in the midst of this bear market Carlson began to develop data with the aim of creating a systematic and disciplined approach that could potentially assist in identifying when markets might turn negative, thereby enabling informed decisions to help manage portfolio risk. However, it is important to note that no tool can guarantee future performance or provide complete protection against market downturns.

- Many investors carry more risk than they want or even realize they are taking.

- Conventional stock and bond portfolios are always invested and always exposed to risk.

- Carlson Wealth Management believes there are times when you should be on defense.

- To identify these times the company utilizes it’s market trend analysis tool that systematically generates alerts to changes in market conditions.

- On Green alerts the objective is to help Grow your portfolio.

- On Yellow, and especially Red alerts, the objective is to help Preserve it.

Help preserve your investments from bad markets.